Government Sugar Mills Face Losses as Share Prices Rise

Government Sugar Mills Face Losses as Share Prices Rise

Blog Article

An unusual rate of increase is being seen in the share prices of state-owned sugar mills that are continuously losing money. On the other hand, these institutions’ financial capability and manufacturing structure have not changed much. Those half-century-old machines have been in use in the nation’s sugar refineries. Approximately six government sugar mills have ceased output for many years due to this. Why, though, is this price increase unusual? In the article of today, we will attempt to determine the answer.

How are the share prices of companies that are in losses increasing?

Their share prices have risen unusually, according to the Dhaka Stock Exchange (DSE), even though they have been in constant losses for the past few years.

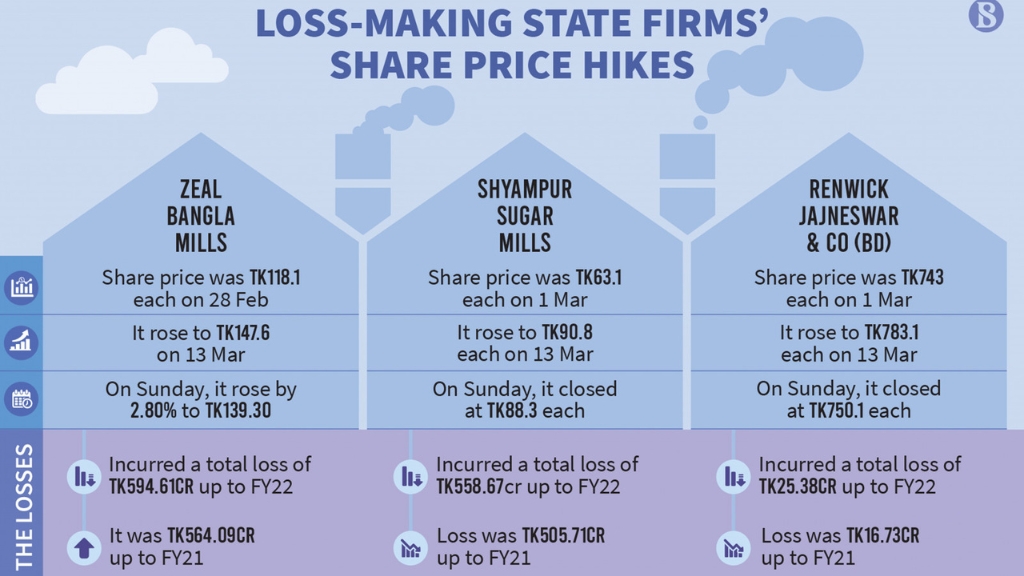

In the fiscal year 2020–21, Zeal Bangla Sugar Mills lost roughly Tk 568.09 crore, which rose to Tk 594.61 crore the following year, according to the company’s audit report. However, the company’s share price was Tk 118.1 on March 1st, 2023, on the DSE, and it rose to Tk 147.6 on March 13th.

The total loss for Shyampur Sugar Mills in the fiscal year 2021–2022 was Tk 558.67 crore, even though the company has not produced since 2020. Despite this, the company’s share price rose from Tk 63.1 on March 1 to Tk 90.8 on March 13.

The share price of Renwick Jajneswar & Company, a manufacturer of equipment for sugar mills, has, nevertheless, also experienced a sharp rise. The price of its shares rose from Tk 743 on March 1 to Tk 783.1 on March 13.

Zeal Bangla Sugar Mills’ managing director, Md. Rabbik Hasan seemed unconcerned about the reasons behind the rise in his company’s share price. “The financial situation has not improved yet, but the sugar mill is operating and sugarcane is being threshed,” he informed the media. I am not aware of the reasons behind the rise in the share price. Nonetheless, Mr. Rabbik thinks that the government is behind this. The mills’ share price is rising as a result of this.

When we brought up this matter with stock market analysts, they told us that it was all hype. According to a stock market specialist, “Some hyper-active investors try to make short-term profits by increasing the share prices of loss-making companies,” despite the market’s funding difficulties.

But the concerning part is that these three companies are not the only ones that experience these kinds of situations. The share prices of a few other losing businesses, such as BD Welding, Osmania Glass Sheet Factory, and Meghna Pet Industries, have recently experienced erratic increases.

Investors may become confused if there are erratic changes in market share prices or if the prices are displayed higher than the real ones. To avoid falling for rumors or market manipulation, stock market experts advise investors to base their judgments solely on sound financial research.

Read More: https://bstandard.info/english/government-sugar-mills-face-losses-as-share-prices-rise/